IMF Releases the 2021 Financial Access Survey Results

November 1, 2021

Washington, DC: On November 1st, 2021, the International Monetary Fund released the results of the twelfth annual Financial Access Survey (FAS). [1] The survey results reveal considerable expansion in the usage of digital financial services during the pandemic, while the usage of traditional financial services remained stable.

The use of digital financial services expanded considerably during the pandemic

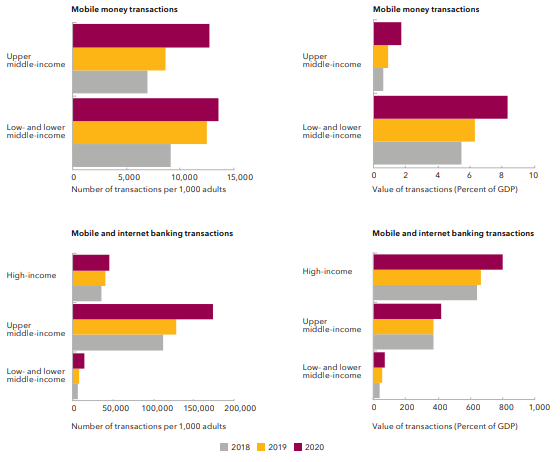

Social distancing and lockdowns have reinforced the use of digital financial services, and the latest FAS data confirm this development. Mobile money usage increased significantly in low- and middle-income economies, with the value of mobile money transactions as a share of GDP increasing by 2 percentage points on average for low- and lower middle-income economies in 2020. The number and the value of mobile and internet banking transactions also grew for all country income groups, most notably among upper middle- and high-income economies.

Mobile money and mobile and internet banking transactions

Source: IMF Financial Access Survey and staff calculations.

Note: These charts show the weighted average of the indicators for respective groups.

Traditional financial services usage remained broadly stable

Aggregated data show that both access to and use of financial services at commercial banks remained broadly stable for countries in all income groups in 2020. This could be a result of the policy measures implemented to support individuals and enterprises during the pandemic. However, in some countries, including a few fragile and conflict-affected states, indicators of financial service usage (particularly those related to lending) fell in 2020. The data on microfinance institutions—which are key financial service providers to more vulnerable groups including women—also point to a few reversals.

Outstanding SME loans remained mostly stable for many low- and lower middle-income economies

SMEs are central to many countries’ economic activity and several governments have taken policy measures to support them. The IMF’s Financial Access COVID-19 Policy Tracker shows that financial assistance in the form of grants has been the most used SME policy measure during the pandemic, followed by public guarantees on loans, loan moratoriums, tax relief, and low interest rates. Many jurisdictions recorded little change or an increase in outstanding loans to SMEs by commercial banks in 2020, potentially because of the effectiveness of these policy measures, despite a few cases where outstanding SME loans declined.

Outcomes were mixed for women’s access to and use of financial services

The latest FAS gender-disaggregated data show mixed results in terms of women’s financial inclusion. Female-owned deposits and loans at commercial banks remained stable or even increased in some countries. These results may be partly attributed to gender-sensitive measures taken to support women’s financial access during the pandemic. However, the number of female borrowers per 1,000 female adults fell in several economies and, in some cases, gains from previous years were reversed in 2020. On average, most indicators point to unchanged gender gaps in financial access during the pandemic, but given the pre-existing gender gaps, advancing women’s financial access in low- and middle-income economies remains challenging.

FAS reporting remained strong despite the challenges posed by the COVID-19 pandemic

As of October 2021, 165 jurisdictions have submitted data to the FAS. The number of jurisdictions reporting gender-disaggregated data increased to 71—a ten percent increase from the previous round. The number of mobile money reporters also grew to 83—roughly 90 percent of countries with live mobile money services.

[1] The FAS is a unique supply-side database on access to and use of financial services, including digital financial services and gender-disaggregated data. It covers 189 jurisdictions, with more than 100 data series and historical data from 2004. The latest FAS data with country-specific metadata are available at http://data.imf.org/FAS, and the 2021 FAS Trends and Development can be downloaded here . The 2021 FAS was made possible with the generous support of the Data for Decisions (D4D) Fund.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: David Sharrock

Phone: +1 202 623-7100Email: MEDIA@IMF.org